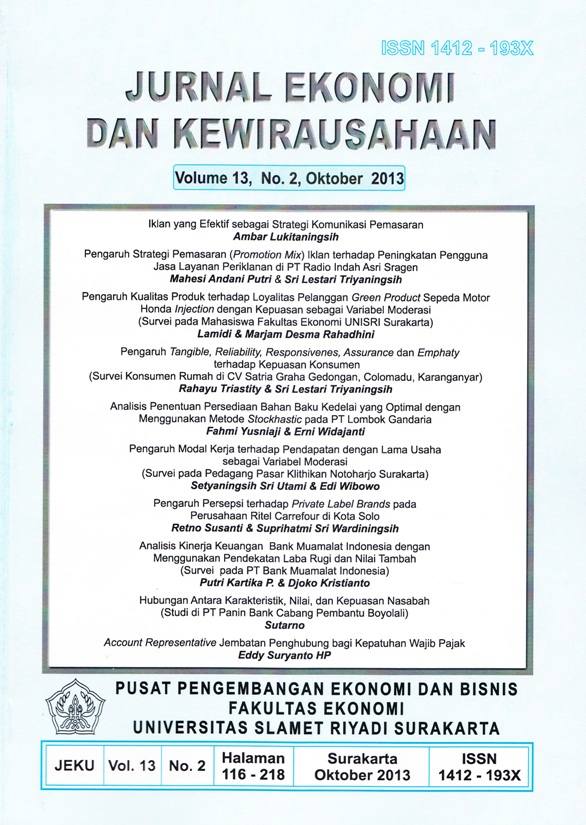

ANALISIS KINERJA KEUANGAN BANK MUAMALAT INDONESIA DENGAN MENGGUNAKAN PENDEKATAN LABA RUGI DAN NILAI TAMBAH (Survei Pada PT Bank Muamalat Indonesia)

Abstract

ABSTRACT

The limitations of SFAS 59, the accounting standard guidelines for Islamic banks do not comply with the principle of full disclosure, led to the information presented in the financial statements are not accurate, especially with regard to the ability of Islamic banks to generate profits. The purpose of this study, to analyze the differences in the financial performance of Islamic banks using the income approach and the value -added based on financial ratios. The results showed that by using a value-added approach, the ratio of financial performance (ROA, ROE, and the ratio of total income to total earning assets) there are differences in quantitative, value-added approach is greater than the income approach.

Keywords: Financial Performance, Islamic Banking, Income Statement, Statement of Value Added

Downloads

Published

Issue

Section

License

Authors who publish this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors can separately make additional contractual arrangements for non-exclusive distribution published by the journal (e.g., publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are allowed and encouraged to send their work via online (e.g., in the institutional repositories or their website) after published by the journal.