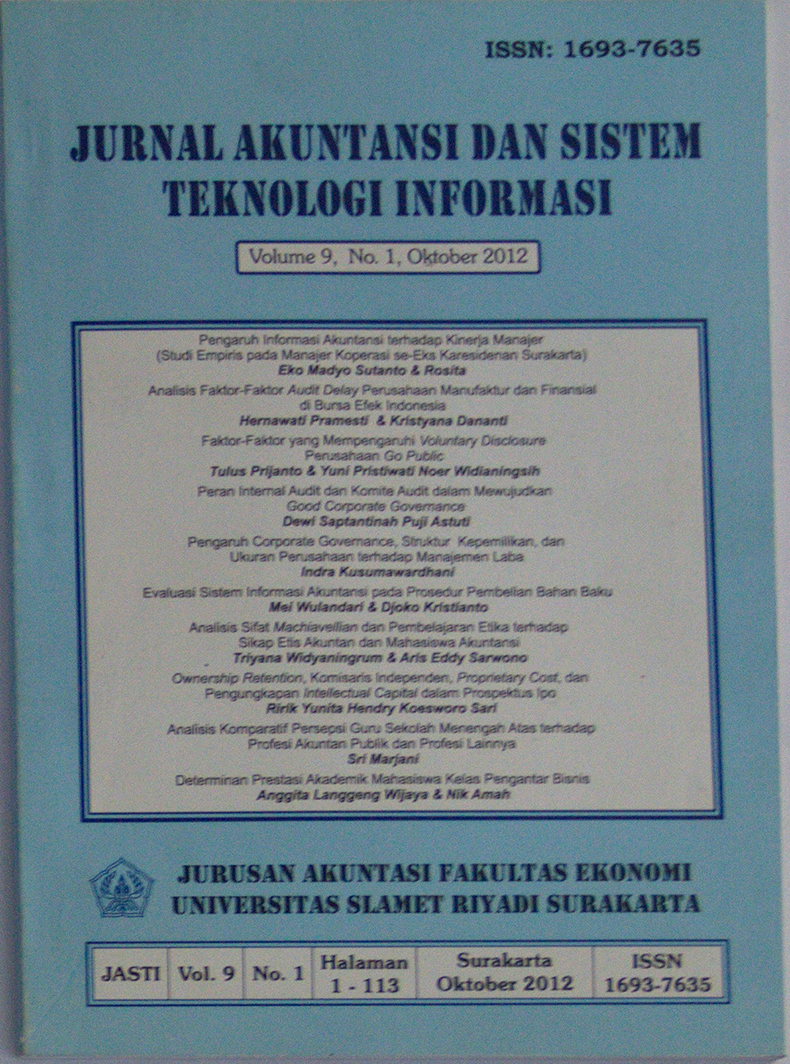

OWNERSHIP RETENTION, KOMISARIS INDEPENDEN, PROPRIETARY COST, DAN PENGUNGKAPAN INTELLECTUAL CAPITAL DALAM PROSPEKTUS IPO

Abstract

ABSTRACTThe first aim of this paper is to look for the possible determinants of the intellectual capital disclosure policy of Indonesian IPOs by relating the content of their prospectuses to ownership retention and independent commissioner. The second aim of this paper is to examine the truth that proprietary cost affects relationship between ownership retention and intellectual capital disclosure, in which proprietary cost was used as a moderating variable. The main result is that ownership retention play a major role in the intellectual capital disclosure policy of firms. Ownership retention has been found positively and significantly affected on intellectual capital disclosure. Inversely, no significant effect was found for independent commissioner. Finally, the result also showed no significant effect of proprietary cost moderating variable on relation between ownership retention and intellectual capital disclosure, leading to H3 rejection.

Keywords: intellectual capital disclosure, ownership retention, independent commissioner, proprietary cost, prospectus.

Downloads

Published

Issue

Section

License

Authors who publish this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors can separately make additional contractual arrangements for non-exclusive distribution published by the journal (e.g., publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are allowed and encouraged to send their work via online (e.g., in the institutional repositories or their website) after published by the journal.